vanguard long term tax exempt fund morningstar

Allspring Municipal Bond Fund -. Under normal circumstances at least 80 of its assets will be invested in securities whose income is exempt from federal and Pennsylvania state taxes.

Blv Etf Approaching An Inflection Point For Investment Grade Bonds Seeking Alpha

Vanguard California Long-Term Tax-Exempt Fund Investor Shares VCITX - Find objective share price performance expense ratio holding and risk details.

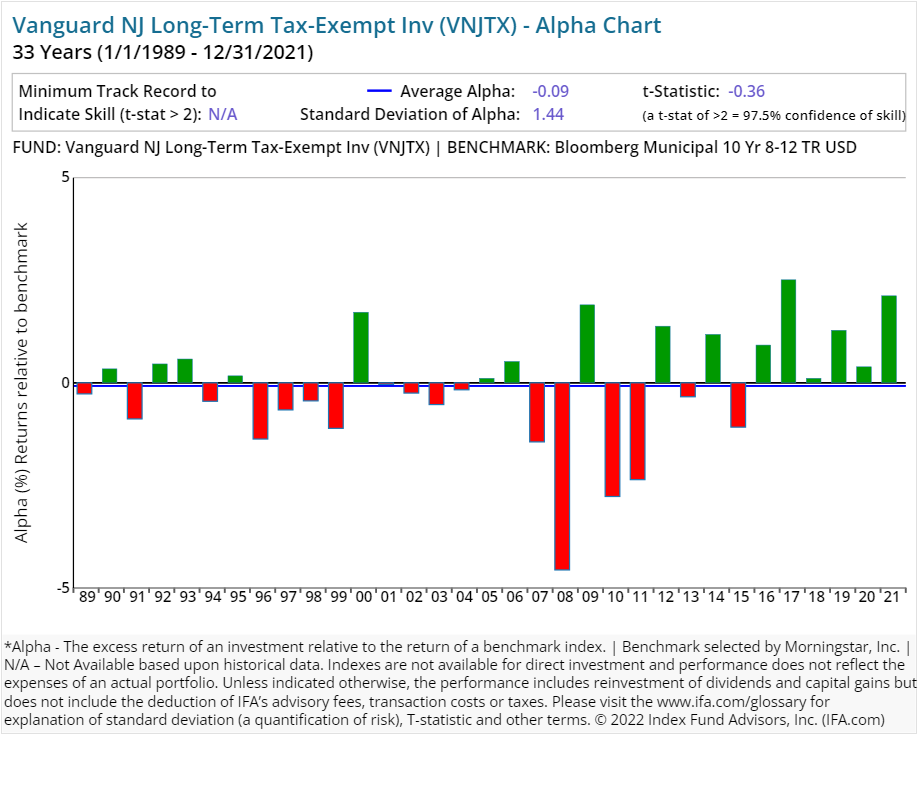

. Vanguard New Jersey Long-Term Tax-Exempt Fund Investor Shares. To achieve that goal the fund. At least 80 of its assets will be invested in securities whose income is exempt from federal and New Jersey state taxes.

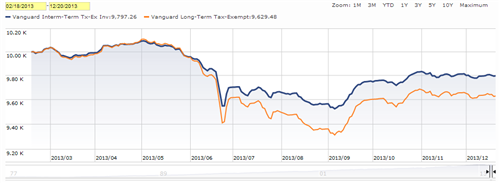

To achieve that goal the fund. Vanguard Intermediate-Term Tax-Exempt Fund Plain talk about risk An investment in the fund could lose money over short or even long periods. Annual Total Return History.

Vanguard Long-Term Tax-Exempt Fund-1361-236. See the company profile for Vanguard Long-Term Tax-Exempt Fund VWLTX including business summary industrysector information number of employees business summary corporate. 148--After taxes on distributions and sale of fund.

Analyst rating as of Mar 11 2022. Vanguard Long-Term Tax-Exempt - Morningstar Document Library. Although the fund has no.

You should expect the funds share price. The Vanguard Long-Term Tax-Exempt Fund seeks to provide a high and sustainable level of current income exempt from federal personal income taxes. Vanguard Long-Term Tax-Exempt VWLTX Performance.

Wells Fargo Advantage Intermediate TaxAMT-Free Fund Investor Class. Institutional investors For retirement plan sponsors consultants and nonprofit. Vanguard High Yield Tax Exempt Fund.

Treasury bill over a three- five- or ten-year period. For people who invest through their employer in a Vanguard 401k 403b or other retirement plan. The Vanguard Long-Term Tax-Exempt Fund seeks to provide a high and sustainable level of current income exempt from federal personal income taxes.

Vanguard Intermediate-Term Tax-Exempt Fund. This rating is based on a funds Morningstar Return its annualized return in excess to the return of the 90-day US. Although the fund has no limitations on the maturities of individual.

Vanguard Limited-Term Tax-Exempt Fund VMLTX 1046 002 019 Vanguard Short-Term Bond Index Fund Investor Shares VBISX.

25 Top Picks For Tax Efficient Etfs And Mutual Funds Morningstar

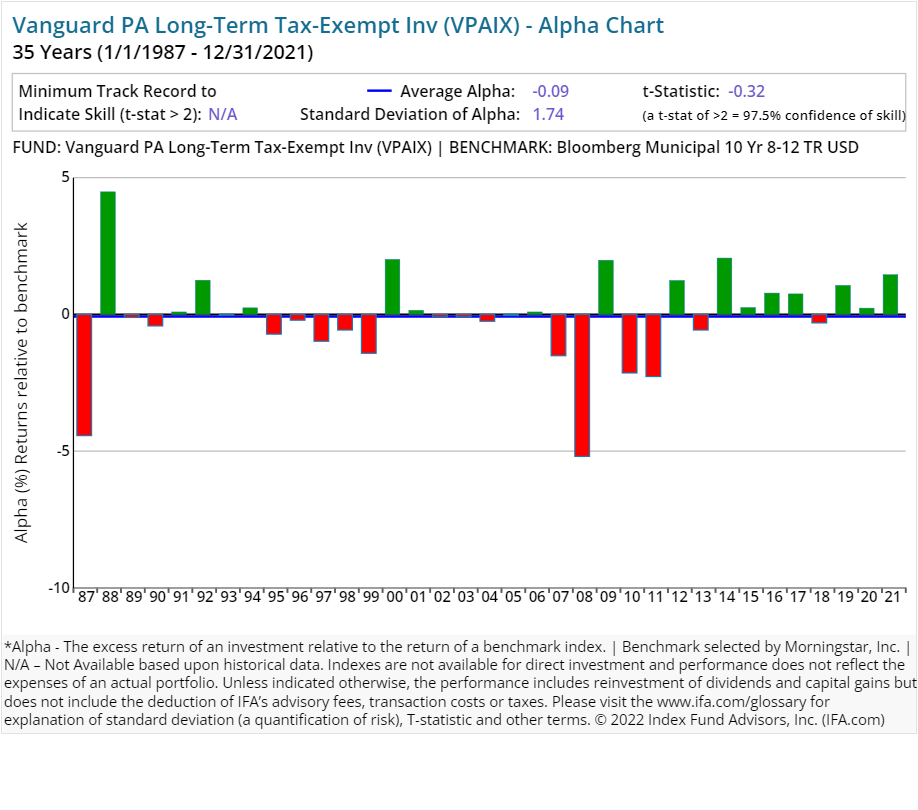

Vanguard S Active Funds A Deeper Look At The Performance

:max_bytes(150000):strip_icc()/financial-services--viewing-financial-markets-for-investing-507826251-5a085f464e4f7d003620bca0.jpg)

A Comprehensive List Of Vanguard Bond Funds And Etfs

10 Best Intermediate Municipal Bond Funds For The Long Term

Is Vanguard Tax Exempt Bond Much Riskier Than Vanguard Total Bond Bogleheads Org

Vanguard S Active Funds A Deeper Look At The Performance

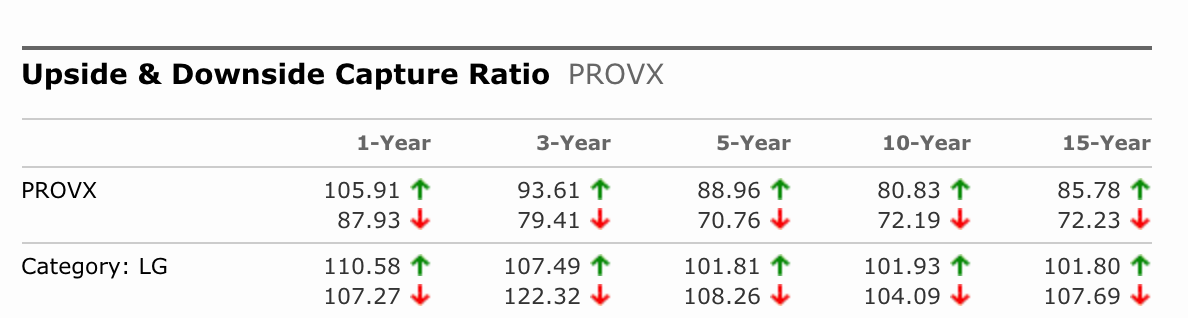

How To Evaluate And Compare Mutual Funds Stablebread

Baby Boomer Retirement Guide The American College

Baby Boomer Retirement Guide The American College

How To Evaluate And Compare Mutual Funds Stablebread

Tax Savings Tools From 401 K S To Etfs Jul 4 2001

A Smart Strategy For Municipal Bond Investors Barron S

How The Largest Bond Funds Fared In The First Quarter Morningstar

Tax Troubles For Some Investors In Vanguard S Target Date Funds The New York Times

It S Been A Poor Year So Far For Municipal Bonds The New York Times

Free Morningstar Premium Mutual Fund Reports Via Public Library Card My Money Blog

Archives For December 2018 Mutual Fund Observer

Are Vanguard Long Term Muni Funds Really Long Term Or Just Long Term In Name Only